Suffolk County NY Property Taxes – 💸 2022 Ultimate Guide & What you Need to Know [rates, lookup, payments, dates]

Moving to Long Island and planning to buy a home? Property taxes are one of the biggest factors affecting your cost of living and something you’ll want to prepare for.

Long Island property tax is notoriously high. That’s no surprise given that New York is known for high taxes. The average effective property tax in New York is 1.72%, well above the national median of 1.1% and among the top 10 in the country. Long Island property taxes are even higher than the state average, but there’s a big difference in tax bills between Nassau and Suffolk Counties.

Here’s everything you need to know about Suffolk County, NY property taxes including how your taxes are calculated and how to pay your bill. We’ve also broken down Suffolk County, Long Island property tax by town to make it easy to find your local tax rate, tax receiver, and property lookup tools.

Table of Contents

Suffolk County Property Tax Overview

New York property tax rates are calculated by local taxing jurisdictions. These taxing authorities include:

- Suffolk County

- Towns

- Villages

- School districts

- Special districts (such as water districts)

Each district adopts a budget and determines how much revenue it must generate from all sources such as user fees, state aid, and sales tax. This total is subtracted from the budget to determine the Tax Levy, or the amount that must be raised through property taxes. Next, the tax levy is divided by the total taxable assessed value of all property in its jurisdiction.

You will see property tax rates expressed as an amount per $1,000 of assessed value.

Nassau County property taxes are complex as levies for cities, villages, and school districts are billed separately from county taxes. However, your Suffolk County property tax is billed with school district taxes rolled into the same tax bill.

Suffolk County, NY property tax is primarily overseen by two offices.

A Suffolk County tax assessor in each town is appointed to determine the taxable value of property and maintain a Town Assessment Roll. This Assessment Roll is used to determine how the annual Tax Warrant is divided. The Tax Warrant is the amount of property taxes that need to be collected for Suffolk County, the town, villages, school districts, and other taxing authorities.

The Receiver of Taxes is an elected official in each town who sends out tax bills based on the Assessment Roll and Tax Warrant. They are also responsible for collecting tax money, maintaining tax rolls, calculating taxes based on incorrect assessments or apportionments, and listing property taxes in arrears.

Suffolk County NY Property Tax Rates

Long Island property taxes are among the highest in the country. The effective Long Island property tax rate was 1.88% in 2017 in Nassau County and 1.90% in Suffolk County. The New York Comptroller’s Office reported in 2019:

- A median Suffolk County tax bill of $9,472

- A median bill of $14,872 in Nassau County

- A New York median property tax bill of $8,081

By comparison, the average property tax bill in the U.S. was $3,399.

There are 125 Long Island school districts and many special districts, many of them Long Island utilities, that set their own tax rates. School districts alone make a big difference in tax rates as moving just a mile into a very good district can double your property tax bill.

In Suffolk County alone, there are also 10 towns, 64 villages, and over 100 municipal corporations that also set property tax rates. This definitely makes understanding your Suffolk property tax bill confusing!

How Suffolk County Property Taxes Are Calculated

Your property tax rate is calculated by multiplying your assessed value (from your tax bill) by your total tax rate.

Your assessed value is a percentage of your market value. Every year, the New York State Board of Real Property Services establishes a residential assessment ratio (RAR). Your town or village’s RAR indicates the percent of your full market value at which you are assessed. With a RAR of 15, for instance, properties are assessed at 15% of their full value. Click here for assessment ratios by town in Suffolk County, NY.

Depending on your district, you may pay many different tax rates for the school district, library, county, town, village, utility districts, and more.

School district rate + library district rate + combined code rate = total tax rate

Note that in some school districts, STAR coverage must be added in. It will not be calculated automatically. If you have a veterans exemption, it only applies to certain codes in your district.

You can view a Long Island property tax map from the Suffolk County Government to see tax districts by town.

Suffolk County Property Tax Grievance

Homeowners should do a Suffolk County assessor property search to check for mistakes before the Grievance Day. Check your town’s tentative Assessment Roll which must be posted on their website.

If you believe your Suffolk County real estate assessment is too high, you can appeal it with your local review board.

After determining your estimated assessed value, you can develop an estimate of your home’s market value. The grievance process begins with an administrative review at the municipal level and may proceed to a judicial review.

This process is done through the Suffolk County, NY property appraiser for your town.

Suffolk County Property Tax Due Dates

Your property taxes can be paid to your town receiver of taxes from December 10 to May 31.

Your first installment is due January 10. Your second installment must be paid on or before May 31.

If your payment is late, you are charged a monthly interest rate starting at 1% and increasing each month until May 31 when your taxes become delinquent.

- Dec. 1 – Jan. 10: No penalty

- Jan. 11 – Feb. 10: 1% penalty

- Feb. 11 – Mar. 10: 2% penalty

- Mar. 11 – Apr. 11: 3% penalty

- April 12 – May 10: 4% penalty

- May 11 – May 31: 5% penalty

If you are receiving the enhanced STAR exemption or over 65 exemption, you have an additional 5 business days past May 31 to pay your tax bill.

Delinquent property taxes are charged an additional 5% penalty and can only be paid to the Suffolk County Comptroller.

Suffolk County Comptroller’s Office

100 Veterans Memorial Hwy

Hauppauge, NY 11788

Phone: (631) 852-1501

Delinquent property taxes can be paid online by clicking here. The Suffolk County Comptroller accepts partial payments of at least $200.

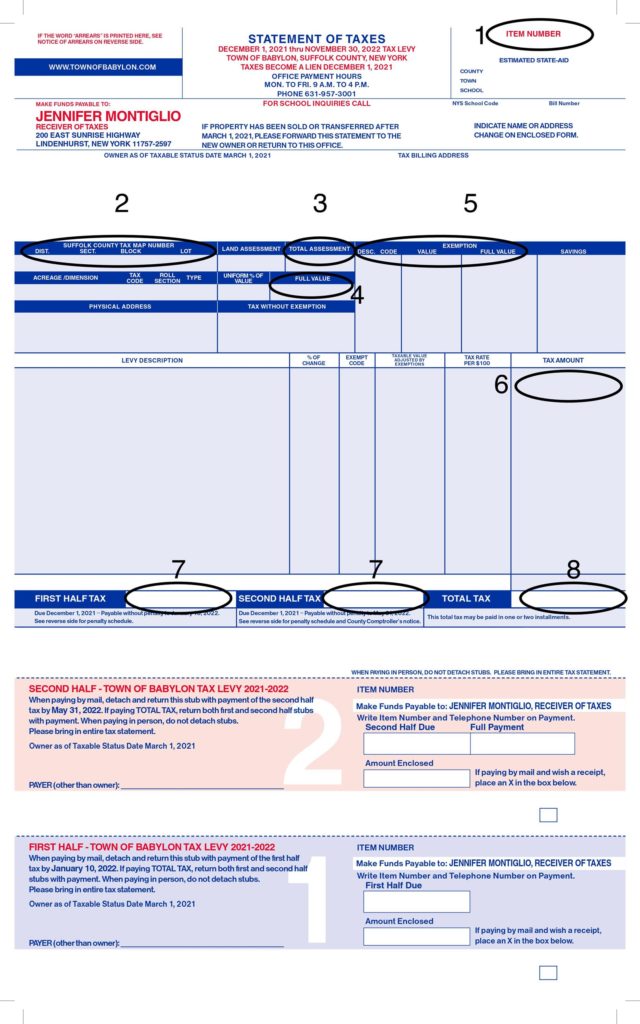

Below you can see a sample Suffolk County property tax bill for the Town of Babylon. Item #3 shows your assessed value, #4 is your full property value, #5 details exemptions you are receiving, and #6 is your total tax amount owed.

Property Tax Exemptions in Suffolk County, NY

Property tax exemptions can lower your tax bill significantly by making a portion of your Suffolk real estate assessment exempt from taxes. You must apply for a tax exemption by March 1 of each year for the exemption to apply to your next property tax bill.

The following are the most common property tax exemptions.

School Tax Relief Plan (STAR) & Enhanced STAR Exemption

New York State pays property taxes on a portion of your assessment as tax relief. The share New York State will pay has been capped at a 2% increase above the previous year’s amount. If your school district increases its taxes more than 2%, you will pay additional taxes on the increase.

Every New Yorker who owns their own home is eligible for a STAR exemption on their primary residence.

If you are a new owner of a property or have never had a STAR exemption on your property before, you must register with the NY State Department of Taxation and Finance.

If eligible, you will receive a STAR credit check every year. Click here to see Suffolk County STAR exemption amounts by town.

Veteran Exemption

Veterans can qualify for three different Suffolk County property tax exemptions. Learn more from the NY Department of Taxation and Finance.

Senior Exemption

The senior citizens exemption can be granted by school districts, towns, and villages to reduce the home’s taxable assessment by up to 50%. Seniors who are 65 or older and meet income guidelines may qualify. Towns, villages, and school districts can set the maximum allowed income to $3,000 to $29,000 for the 50% exemption or choose a sliding scale option based on income.

Disabled Exemption

School districts, towns, and villages can choose to offer an exemption for disabled homeowners. This exemption requires documentation and income requirements and may be a basic exemption of 50% or a sliding scale option.

Town of Babylon Taxes

How much are Town of Babylon taxes? You’ll need to check your district to see your total tax rate which includes the school district, library district, and combined code rate.

You can see 2021/2022 Town of Babylon property tax rates here. Note that there are 10 school districts in the Town of Babylon with property tax rates ranging from 199.2968 (Half Hollow Hills) to 241.1253 (Wyandanch) per $100 of assessed value.

The Town of Babylon RAR is 0.87. Homes are assessed at 0.87% of their full value. Village assessment ratios include: Amityville (2.22), Babylon (2.00), and Lindenhurst (1.27).

Town of Babylon Assessor

- John Ripple, Town Assessor

- Memorial Village Hall, 430 S Wellwood Ave, Lindenhurst, NY 11757

- Phone: (631) 957-3014

Town of Babylon Receiver of Taxes

- Jennifer Montiglio, Receiver of Taxes

- 200 E. Sunrise Highway, Lindenhurst, NY 11757

- Phone: (631) 957-3001

Town of Babylon Property Search

You can use the Town of Babylon property portal to view property information. The Town of Babylon taxes lookup tool shows information such as assessed value, exemptions, and your current tax bill. You will need your item number or address.

Pay Town of Babylon Taxes

Town of Babylon taxes due: January 10 (first installment), May 31 (second installment)

You can pay your property tax bill online through ACI Payments.

You can pay in person using cash, check, or money order. Debit and credit cards are not accepted for in-person payments, and only checks are allowed with drop box payments.

You can also pay by mail by sending a check made out to Jennifer Montiglio, Receiver of Taxes at the address above.

Town of Brookhaven Taxes

How much are Town of Brookhaven property taxes? You can click here for 2021/2022 Brookhaven property tax rates by district. There are 20 school districts in Brookhaven with tax rates ranging from 21.849 (Fire Island) to 367.578 (Bayport) per $100 of assessed value.

The Town of Brookhaven RAR is 0.74. Homes are assessed at 0.74% of full value. Village assessment ratios: Bellport (10.63), Patchogue (4.86), Shoreham (1.29), Port Jefferson (0.90), and Lake Grove (0.77).

Town of Brookhaven Assessor

- Richard P. DeBragga

- 1 Independence Hill, Farmingville, NY 11738

- Phone: (631) 451-6300

Town of Brookhaven Receiver of Taxes

- Louis J. Marcoccia, Receiver of Taxes

- 1 Independence Hill, Farmingville, NY 11738

- Phone: (631) 451-9009

Brookhaven Tax Portal & Property Search

The Brookhaven Tax Portal allows you to access property tax information for your property including your assessed value and tax bill.

Pay Town of Brookhaven Property Taxes

Town of Brookhaven taxes due date: January 10 (first installment), May 31 (second installment)

You can pay Town of Brookhaven taxes online by e-check or credit card with a small processing fee.

Payments can be sent by mail to the Brookhaven town receiver of taxes if they are postmarked before the due date.

To pay in person, you will need to make an appointment online.

Town of East Hampton Taxes

The Town of East Hampton RAR is 0.58. Homes are assessed at 0.58% of full value. The Village of Sag Harbor assessment ratio is 106.82. Click here to see the 2021 East Hampton assessment roll.

Town of East Hampton Assessor

- Eugene DePasquale, Town Assessor

- 300 Pantigo Place Suite 108, East Hampton, NY 11937

- Phone: (631) 324-4187

Town of East Hampton Receiver of Taxes

- Rebecca Rahn (interim)

- 300 Pantigo Place Suite 106, East Hampton, NY 11937

- Phone: (631) 324-2770

Pay East Hampton Property Taxes

You can pay your property tax bill in person or in the mail slot at the Tax Receiver’s Office location above.

Check payments may be mailed to the tax receiver at the above tax office or PO Box 5870, Hauppauge, NY 11788.

To pay by phone with a credit card, debit card, or check, call the tax receiver’s office.

Cash and check payments are accepted at Dime Bank.

The easiest way to pay your Town of East Hampton property taxes is to pay online. Click here to pay by debit/credit card or e-check.

Town of Huntington Taxes

How much are Town of Huntington property taxes? It depends on your district. You can use the tax rate schedule and list of taxable districts to calculate your rate. Your property tax rate will be:

School District rate + Library District rate + Combined Code

Multiply your tax rate by the assessed value on your tax bill.

Note that Huntington has nine school districts with tax rates ranging from 198.656 (Northport) to 298.299 (Elwood).

The Town of Huntington RAR is 0.63. Homes are assessed at 0.63% of full value. Village assessment ratios: Asharoken (3.94), Huntington Bay (0.67), Lloyd Harbor (0.66), and Northport (1.06).

Town of Huntington Assessor

- Lisa Leonick, Town Assessor

- Town Hall (Room 100), 100 Main Street, Huntington, NY 11743

- Phone: (631) 351-3226

Town of Huntington Receiver of Taxes

- Jilian Guthman, Esq., Receiver of Taxes

- Huntington Town Hall, 100 Main St., Huntington, NY 11743

- Phone: (631) 351-3217

Town of Huntington Property Search

You can click here to do a Huntington, Suffolk County NY property search. View your property tax bill online, see your property tax history, and check your home’s assessed value. You can search by Suffolk County tax map number or address.

Pay Huntington Property Tax

Town of Huntington taxes due: January 10 (first installment), May 31 (second installment)

Taxes are payable to the Town of Huntington Receiver of Taxes from December 10 to May 31. Late taxes are charged a 1 to 5% monthly interest rate until May 31. After May 31, Town of Huntington property taxes become delinquent with an additional 5% penalty. Delinquent taxes are payable to the Suffolk County Comptroller.

Property tax payments can be mailed to the receiver of taxes above.

You can pay in person at the above address between 9 am and 4 pm, Monday to Friday, or use the Town Hall Drop Box. To pay by phone, call 1-800-272-9829.

Click here to pay your Town of Huntington property taxes online by credit/debit card or e-check.

Town of Islip Taxes

You can see 2021/2022 rates for Town of Islip taxes by clicking here. You’ll notice the town has joint school and library district tax rates unlike the Suffolk County property tax rate in most towns. Click here for the Town of Islip assessment roll.

The Town of Islip RAR is 9.28. Homes are assessed at 9.28% of full value. Village assessment ratios are: Brightwaters (9.72), Islandia (9.42), Ocean Beach (8.19), and Saltaire (8.42).

Islip Town Assessor

- Anne M. Danziger, Town Assessor

- 40 Nassau Avenue, Islip, NY 11751

- Phone: (631) 224-5585

Town of Islip Receiver of Taxes

- Andy Wittman, Receiver of Taxes

- 40 Nassau Avenue, Islip, NY 11751

- Phone: (631) 224-5580

Pay Islip Taxes

Click here to pay your Town of Islip taxes. You will need to register for an account. Payments can be made by e-check or credit card but Amex is not accepted.

You can also pay in person or by mail at the Receiver of Taxes Office address above.

Town of Riverhead Taxes

How much are Town of Riverhead property taxes? Click here for 2021/2022 Riverhead tax rates. You can see Riverhead property assessments and tax totals by address or parcel on the 2021/2022 Tax Roll.

The Town of Riverhead RAR is 11.80. Homes are assessed at 11.80% of full value.

Town of Riverhead Assessor

- Laverne D. Tennenberg

- 200 Howell Avenue, Riverhead, NY 11901

- Phone: (631) 727-3200

Town of Riverhead Receiver of Taxes

- Laurie Zaneski, Receiver of Taxes

- 200 Howell Avenue, Riverhead, NY 11901

- Phone: (631) 727-3200

Pay Riverhead Property Taxes

You can pay your property tax bill by clicking here. This Suffolk County property tax search tool for the Town of Riverhead shows assessments, tax rates, your tax bill, and other important information.

Town of Shelter Island Taxes

Click here to see 2021/2022 Shelter Island property tax rates. The 2021/2022 Shelter Island Tax Roll is also available. Homes in Shelter Island are assessed at 100% of full value.

Shelter Island Assessor

- Pat Castoldi, Assessor

- Judith Lechmanski, Assessor

- 38 North Ferry Road, PO Box 970, Shelter Island, NY 11964

Shelter Island Receiver of Taxes

- Annmarie Seddio, Tax Receiver

- 38 North Ferry Road, PO Box 1854, Shelter Island, NY 11964

- Phone: (631) 749-3338

Pay Shelter Island Property Taxes

Click here to pay your taxes online by credit card or e-check. You can also pay taxes by phone by calling 1-888-877-0450. Payments are accepted in person or at the drop box in front of the Assessor/Tax Receiver office. Cash, check, and money orders are accepted in person.

Town of Smithtown Taxes

How much are Town of Smithtown property taxes? You can see 2022 property tax rates here and 2021 tax rates. The Town of Smithtown RAR is 1.12. Homes are assessed at 1.12% of full value.

Town of Smithtown Assessor

- Peter D. Johnson Esq. ISO

- 40 Maple Avenue, Smithtown, NY 11787

- Phone: (631) 360-7560

Smithtown Receiver of Taxes

- Deanna Varricchio, Receiver of Taxes

- 99 W. Main Street, Smithtown, NY 11787

- Phone: (631) 360-7610

Town of Smithtown Property Search & Payments

Click here to view and pay your Smithtown taxes. Payments can be made by mail, in person, or through the drop box at the Receiver of Taxes Office at Smithtown Town Hall.

Town of Southampton Taxes

How much are Town of Southampton property taxes? You can view the 2021 Southampton tax roll which lists assessments and tax bills for all properties.

The Town of Southampton RAR is 100.00 with homes assessed at 100% of full value. Village assessment ratios are: Southampton (0.81) and West Hampton Dunes (92.39).

Town of Southampton Tax Assessor

- Lisa Goree, Sole Assessor

- Maureen Berglin, Deputy Town Assessor

- Town Hall, 116 Hampton Rd, Southampton NY 11968

- Phone: (631) 283-6020

Town of Southampton Receiver of Taxes

- Hon. Theresa A. Kiernan

- Town Hall (Main Floor), 116 Hampton Road, Southampton, NY 11968

- Phone: (631) 702-2470

Southampton Property Search

The Southampton property search tool here is an interactive Suffolk County property tax lookup tool that lets you view assessments, exemptions, and your current bill.

Pay Southampton Tax Bill

You can pay your taxes by mail or in person at the Office of the Tax Receiver. Your Southampton tax bill can be paid online via ACH payment or debit/credit card.

Town of Southold Taxes

How much are Town of Southold taxes? You can see 2021 Southold property tax rates here. There are six school districts in the town with tax rates ranging from 364.328 to 983.159 per $1,000 of assessed value.

Homes in the Town of Southold are assessed at 0.88% of full value.

Town of Southold Assessor

- Richard L. Caggiano, Town Assessor

- Charles Sanders, Town Assessor

- Southold Town Hall, Board of Assessors, 53095 Route 25, P.O. Box 1179, Southold, NY 11971

- Phone: (631) 765-1937

Town of Southold Receiver of Taxes

- Kelly J. Fogarty, Receiver of Taxes

- Southold Town Hall, Tax Receiver’s Office, 53095 Route 25, Southold, NY 11971

- Phone: (631) 765-1803

Southold Property Search

The Town of Southold property search tool allows you to view property information online including assessments, exemptions, and your tax bill. You can also pay your bill through the system.

Pay Southold Town Taxes

Property taxes can be made in person at the Southold Town Hall or during branch hours at Dime Community Bank (Southold, Greenport, or Mattituck) or Peoples United Bank (Cutchogue).

You can mail your tax payment to PO Box 1409, Southold, NY 11971.

You can click here to pay Southold taxes online with a credit card or e-check.

Suffolk County Property Tax FAQ

Why are property taxes so high on Long Island?

High home prices contribute to high property tax bills on Long Island, but that’s not the whole story. School district taxes are the biggest factor making Long Island property taxes so high and account for over 60% of your tax bill. There are also hundreds of special tax districts for services like sewer and police.

What town on Long Island has the lowest property taxes?

The Sagaponack school district in Southampton, Suffolk County has the lowest property taxes in Long Island compared to value with an effective tax rate in New York at $3.93 per $1,000 – but very high home values.

What town on Long Island has the highest property taxes?

The village of Lloyd Harbor in Huntington has one of the highest property tax bills – an average annual combined tax bill of $38,341 for a median-value house. Amityville village in the Town of Babylon has the highest effective tax rate at $39.43 per $1,000.

When are property taxes due in Suffolk County NY?

Your Suffolk County property tax bill is sent out once per year. Your first half payment is due on January 10. The second half payment is due May 31.

Now that you have a better understanding of how Suffolk County, NY property taxes work, are you ready to embrace homeownership? If you’re buying a home or moving in Nassau or Suffolk County, Zippboxx is here to help. Our dependable Long Island movers will have you settled into your home quickly without the stress or hard work.