Nassau County Property Tax – 🎯 2022 Ultimate Guide to Nassau Property Tax [rates by town, property search, payments, due dates]

Are you moving to Long Island or just ready to buy a home ? You have probably given some thought to the cost of living on Long Island and how owning a home will fit into your budget. One of the biggest and most overlooked costs of homeownership is property taxes. With high Nassau County real estate prices and notoriously high tax rates, you can expect a large tax bill. In fact, Nassau County real estate taxes are among the highest in the country!

This complete guide covers everything you need to know about Nassau property tax including taxes by town and how to lower your tax bill.

Nassau County Property Tax Overview

Your Nassau County NY property tax is determined by local taxing jurisdictions including:

- Nassau County

- Your town

- Your village

- Your school district

- Special districts like water districts

Every tax district sets an annual budget. They determine how much revenue they should generate from New York state aid, sales tax, and user fees. This total is subtracted from the annual budget to set a tax levy or how much needs to be raised through property taxes in their jurisdiction. The tax levy is divided by the total assessed value of all real estate in the jurisdiction. This creates your tax rate.

Unlike Suffolk County property taxes , which include school district taxes on the county tax bill, taxes in Nassau County come in the form of separate bills for school districts, Nassau County towns and cities , and village taxes.

Nassau County Tax Assessment & County Assessor

Property taxes are determined by on your home’s assessed value which is based on your home’s market value. Assessors in cities, towns, and villages estimate the market value of property in their jurisdiction then multiply it by the municipality’s level of assessment (LOA) or assessment ratio. Depending on the municipality, your property may be assessed at less than 5% or up to 100% of its market value .

New York uses equalization rates because there is no fixed percentage at which property is assessed, not all municipalities use the same percentage, and some taxing authorities like school districts cross multiple taxing boundaries.

If your municipality has an equalization rate of 100, it means they assess property at 100% of its market value. A rate below that means property is assessed lower than its market value.

Once your Nassau County assessment is determined, the assessor computes your taxable assessed value. This is your assessed value minus property tax exemptions.

Nassau County Department of Assessment

The Department of Assessment develops assessments for all property in the county. The Nassau County assessment roll includes more than 420,000 properties. The department maintains Nassau County land records and the Nassau County tax map. Applications for property tax exemptions and the STAR program are handled by the Department of Assessment.

Nassau Tax Assessor’s Office

- Acting Nassau County Assessor: Matthew R. Cronin, IAO.

- Address: 240 Old Country Rd, Mineola, NY 11501

- Phone: (516) 571-1500

- Hours: Monday to Friday, 8 am to 4:30 pm

What Is the Nassau County Property Tax Rate?

Long Island property tax is among the country’s highest due to high home prices and high tax rates. The New York Comptroller’s Office in 2017 reported an average effective Nassau County property tax rate of 1.88%.

In 2019, the median Nassau County tax bill was $14,872 . By comparison, the median tax bill in Suffolk County was $9,472 and the New York median was $8,081.

Nassau property owners pay more than 4x more in property taxes than the average American.

The 2021 Nassau County property tax rate was 5.15 per $1,000 of full market value plus municipal tax rates for towns and/or villages, school district taxes, and taxes for special districts .

Municipal tax rates range from 0.03 to 18.05 per $1,000 of full market value depending on the town and village. Nassau County school district tax rates range from 10.68 to 42.63 per $1,000 of full market value.

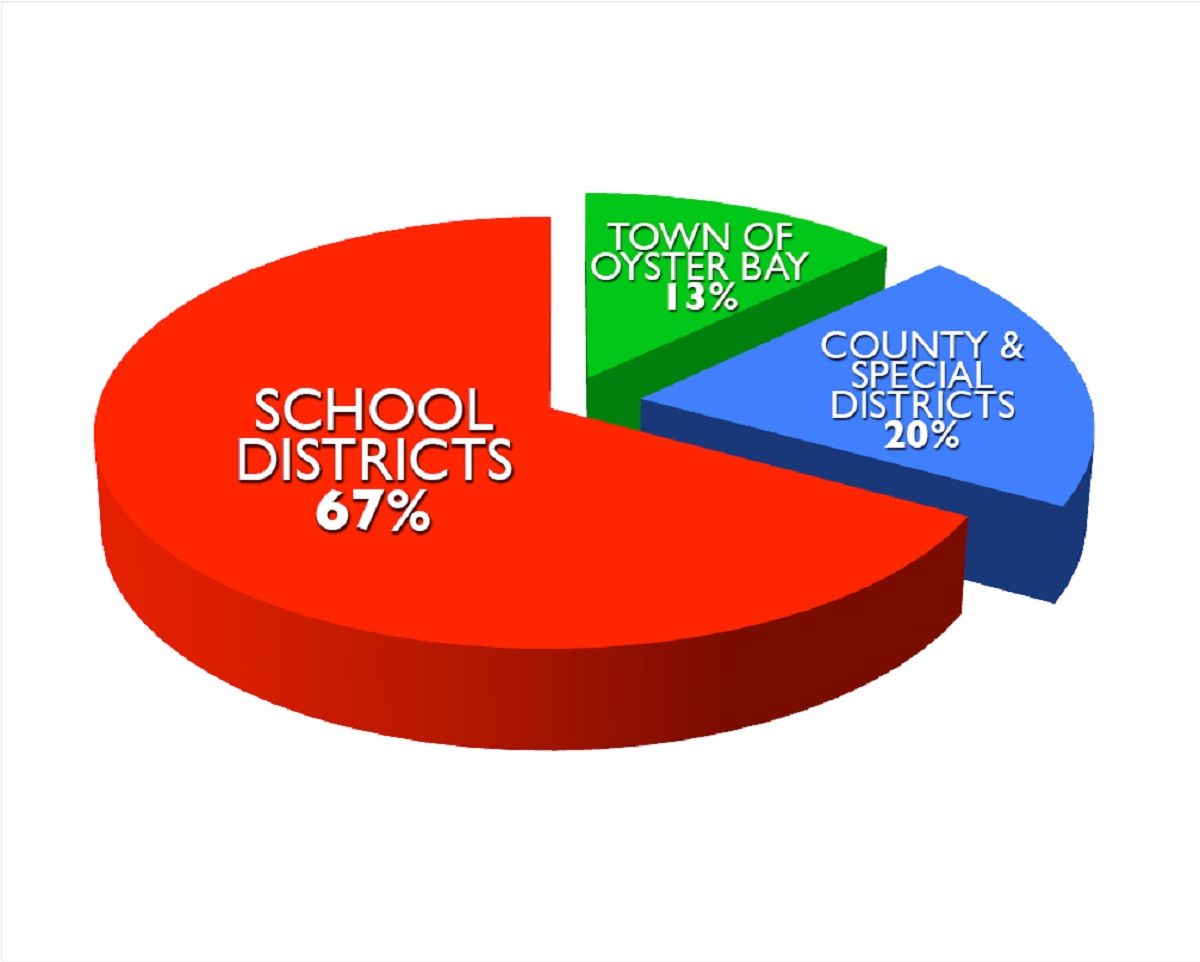

Taxes for Long Island school districts account for the largest share of your total tax bill.

How to Calculate Nassau County Property Tax

To calculate your Nassau County property tax bill, you will need to know your home’s market value, the level of assessment for the municipality or tax authority, and the tax rate.

As a general rule, your full market value is first multiplied by the equalization rate (or uniform percentage of value) to determine a total assessed value. This is multiplied by the tax rate based on the municipality’s level of assessment (LOA). This is done for each taxing authority as some assess taxes based on different assessment ratios. This does not consider tax exemptions.

For example, property in Roslyn Heights in the Town of North Hempstead has a full market value of $717,000. The uniform percentage of value is 0.10. That results in an assessed value of $717. The town and county assess at 100% of this assessed value.

You can then multiply this taxable assessed value by the tax rate for the municipality.

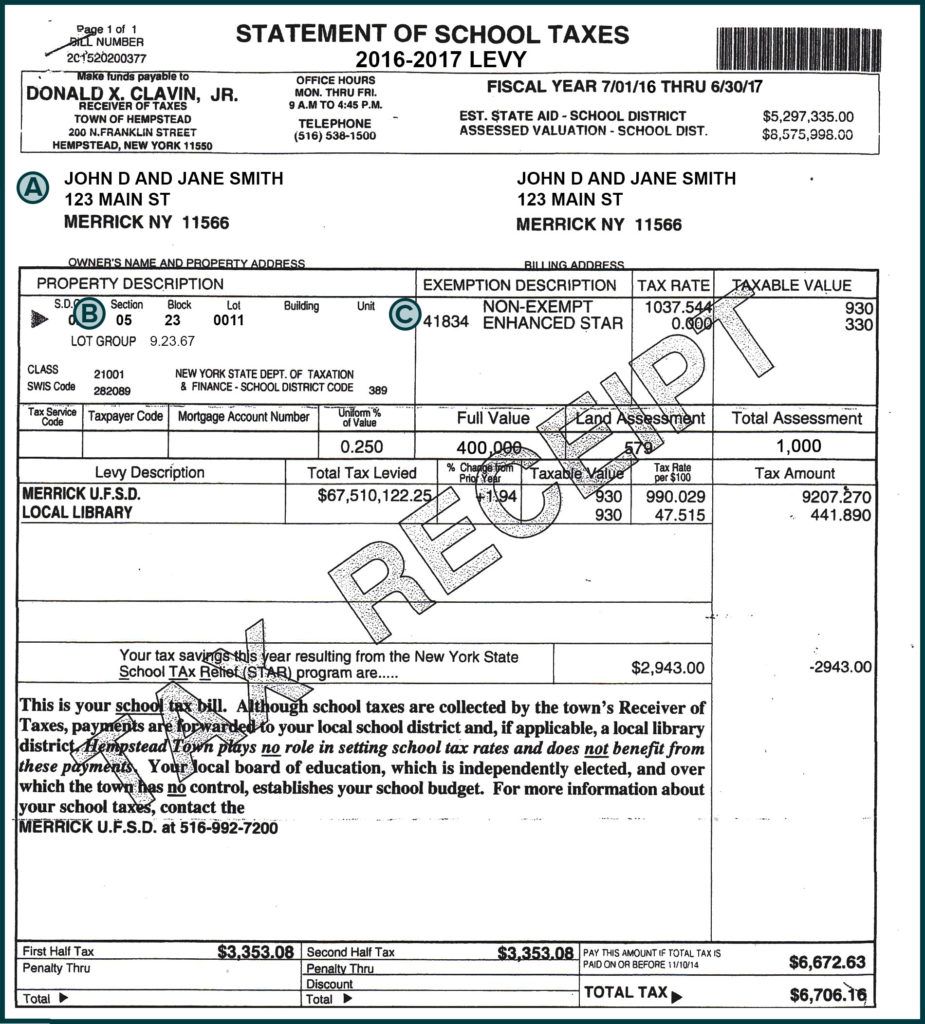

Below is a sample Nassau property tax bill. This example shows a STAR exemption amount – STAR credits are not issued for years in which you receive a STAR exemption to reduce your taxes.

Nassau County Property Taxes by Town

The 2021 Nassau County tax rate was 5.15 per $1,000 of full market value. Most Nassau County property owners also pay a municipal tax rate for their city or town plus school district taxes. Some villages and special tax districts have additional tax levies.

Below are Nassau property taxes in 2021 for municipal taxes and school district taxes in the county. Note that these tax rates are composite rates; check with your city, town, village, and school district for the tax rate for your parcel.

| 2021 Nassau County Municipal Tax Rates | |

| Municipality | Tax Rate (Per $1,000 of Full Value) |

| City of Glen Cove | 7.45 |

| City of Long Beach | 7.21 |

| Town of Hempstead | 2.58 |

| Hempstead villages | 1.85 (East Rockaway) to 18.05 (Hempstead) |

| Town of North Hempstead | 1.49 |

| North Hempstead villages | 0.92 (Plandome Heights) to 7.36 (Lake Success) |

| Town of Oyster Bay | 4.60 |

| Oyster Bay villages | 0.68 (Farmingdale) to 5.32 (Centre Island) |

| Nassau County Property Tax Rates for School Districts (2020) | ||

| Municipality | Equalization Rate | Tax Rate (Per $1,000 of Full Value) |

| City of Glen Cove | 100.0 | 16.69 |

| City of Long Beach | 3.28 | 16.64 |

| Town of Homestead | 0.18 | 9.57 to 42.53 |

| Town of North Hempstead | 0.17 | 14.0 to 37.14 |

| Town of Oyster Bay | 0.17 | 10.68 to 33.89 |

Here are sample school district tax rates for the Town of Hempstead :

- Westbury: 9.57

- Uniondale: 11.60

- Freeport: 16.33

- Hempstead: 18.31

- Merrick : 33.42

- Hewlett-Woodmere: 33.97

- North Bellmore: 34.31

- Levittown: 42.53

Sample school district tax rates for the Town of North Hempstead:

- Great Neck: 14.0

- Manhasset: 14.21

- Roslyn: 20.40

- Herricks: 29.77

- East Willston: 29.78

- Jericho: 37.14

Sample school district tax rates for the Town of Oyster Bay :

You can see 2022 Nassau County assessment rolls here with current tax rates, equalization rates, and assessment levels.

Make a Nassau County Property Tax Payment – Nassau County Property Tax Due Dates & Payments by Town

Property taxes are collected by the Receiver of Taxes in each town. Below is information on how to make your Nassau County tax payments, due dates, and important links .

Note that general property tax and school tax can only be paid through the town Receiver of Taxes until the levy closes, typically two weeks after the deadline to pay without penalty. After that, you must pay delinquent property taxes at the Nassau County Treasurer’s Office.

Village property taxes are usually collected separated by each village.

Long Beach Property Taxes

- Long Beach, NY Treasurer

- Online portal to make Long Beach, NY property tax payments

Long Beach, Nassau County property tax due dates:

- First half city tax: July 1 through July 31

- Second half general tax: July 1 through August 10

- First half school tax: Oct. 1 through Nov. 10

- Second half city tax: Jan. 1 through Jan. 31

- First half general tax: Jan. 1 through February 10

- Second half school tax: Apr. 1 through May 10

Hempstead Property Taxes

- Town of Hempstead Receiver of Taxes

- Online portal to make Town of Hempstead tax payments

Town of Hempstead, NY property tax due dates:

- First half school tax: Oct. 1 through Nov. 10

- First half general tax: Jan. 1 through Feb. 10

- Second half school tax: Apr. 1 through May 10

- Second half general tax: July 1 through Aug. 10

Glen Cove Property Taxes

- Glen Cove Controller

- Glen Cove property tax portal to make payments online

Glen Cove, NY property tax due dates:

- First half city tax: Dec. 1 through Jan. 10

- First half county tax: Jan. 1 through Feb.10

- Second half school tax: Feb.1 through March 1

- Second half city tax: June 1 through July 10

- Second half county tax: July 1 through Aug. 10

- First half school tax: Aug. 1 through Sept. 1

There is a discount on city taxes paid in full during the first time period (December 1 through January 10).

North Hempstead Property Taxes

- Town of North Hempstead Receiver of Taxes

- Online portal to make North Hempstead tax payments

North Hempstead, NY property tax due dates:

- First half school tax: Oct. 1 through Nov. 10

- First half general tax: Jan. 1 through Feb. 10

- Second half school tax: Apr. 1 through May 10

- Second half general tax: July 1 through Aug. 10

Oyster Bay Property Taxes

- Town of Oyster Bay Receiver of Taxes

- Online portal to make Oyster Bay, NY tax payments

Oyster Bay property tax due dates:

- First half general tax: Jan. 1 through Feb. 10

- Second half general tax: July 1 through Aug. 10

- First half school tax: Oct. 1 through Nov. 10

- Second half school tax: Apr. 1 through May 10

Nassau County Property Search

Need a copy of your property tax bill? Want to review your Nassau County assessment or current tax rates? You can do it all easily online.

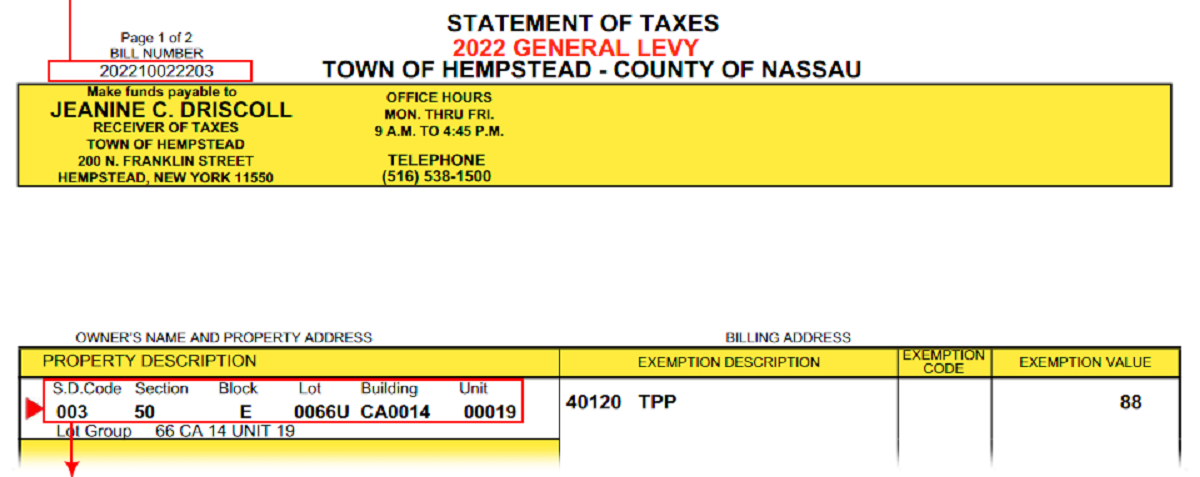

Use the Nassau County Land Record viewer gives you access to information maintained by the Department of Assessment. Search by property address or section, block, and lot (SBL) to see Nassau County NY property records and important information:

- Nassau County tax map to identify tax district boundaries

- Current and historic tax rates

- Past tax payments

- Assessment roll information

- Property photographs

- Tax exemptions and amounts

- Comparable home sales

You can also use this MyNassauProperty tool. Use My Nassau County property lookup to see your fire district, school district, police precinct, road management officials, and elected officials.

If you need a Nassau County property tax lookup, use the tool provided by your town Receiver of Taxes. Each town offers a Nassau County tax lookup portal that lets you pay your taxes online and see past tax payments, current taxes due, assessment information, and more.

Nassau County property tax lookup by town:

How to File a Property Tax Grievance in Nassau County –Appealing Your Nassau Property Assessment

Your property is assessed every year. If you do not agree with your assessed value, you have the right to appeal. You must appeal your assessment before your property taxes based on the new assessment are billed. For 2022, appeals were accepted between January 3 and March 1, 2022.

You can file a request for the Assessment Review Commission (ARC) to review your assessment online. Click here to file an appeal or check the status of an appeal before the Nassau County tax grievance deadline.

Property Tax Exemptions – New York STAR Exemption & More

Applying for tax exemptions can reduce your real estate taxes significantly by making a percentage of your assessment exempt from taxes.

Here’s an overview of exemptions that can reduce property tax in Nassau County. Note that property tax exemption applications for 2023/2024 must be submitted by January 2, 2023 .

STAR Program

When you buy a home, you must register with the NY Department of Taxation and Finance to qualify for the STAR Program. Eligible owners receive a check from NYS rather than a direct school tax exemption. You are eligible for the Basic STAR program if your primary residence does not exceed $500,000. The Enhanced STAR program is offered to seniors who meet income guidelines.

Veterans Exemptions

Certain veterans are entitled to an exemption on county and town property taxes along with school taxes for districts that have chosen to offer a reduction.

Senior Citizens’ Exemption

Seniors who meet income guidelines are entitled to an exemption of 5% to 50% on Nassau County, town, and school taxes. Special district taxes are not reduced.

Limited Income and Disabilities Exemption

Homeowners with a mental or physical impairment that makes them substantially unable to engage in major activities of life can qualify for an exemption of up to 50% of their assessment.

Volunteer Firefighters & Ambulance Workers

With at least five years of service, ambulance workers and volunteer firefighters can qualify for an exemption of 10% of their home’s assessed value.

Nassau Property Tax FAQ

When are Nassau County taxes due?

Your Nassau County general tax due date is February 10 (first half) and August 10 (second half). City or town taxes and school taxes are due in two installments with due dates depending on the municipality.

How much is property tax in Nassau County?

The median Nassau County tax bill was $14,872 in 2019. Without accounting for exemptions, the Nassau property tax rate is 5.15 per $1,000 of full value in 2021 plus town taxes of 0.03 to 18.05. School taxes range from 10.68 to 42.63 per $1,000 of full market value without considering STAR program benefits.

How do I pay my Nassau County property tax bill?

Nassau County property tax is paid to the town Receiver of Taxes until the tax levy closes. Delinquent taxes must be paid to the Nassau County Treasurer’s Office. All cities and towns offer online tax payments plus mail and in-person options.

Now that you know everything there is to know about Nassau County, Long Island property tax, are you ready to take the plunge into buying a home? Once you’ve started the process and you have a closing date on the horizon, give us a call at Zippboxx to get started with a free, personalized moving estimate. We can have you quickly settled into your new home without the stress and long days of unpacking so you can enjoy everything Long Island living has to offer.

SHARE THIS POST:

Zippboxx

On-Demand Storage Experts

Zippboxx is much more than a team of people who love to keep you moving. We’re deeply invested in our people and our community.

Leave A Comment

Contact Zippboxx

Blog - Website Form

Recent Posts

Services We Offer